What is Arbitrage Trading?

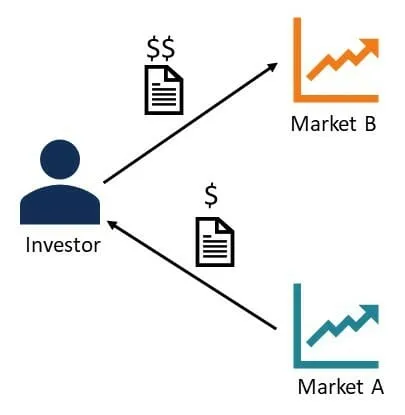

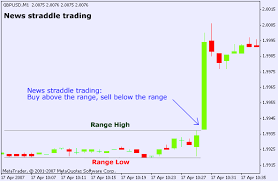

Arbitrage trading is trading that exploits the tiny differences in price between identical assets in two or more markets. The arbitrage trader buys the asset in one market and sells it in the other market at the same time in order to pocket the difference between the two prices. Despite the disadvantages of pure arbitrage, risk arbitrage is still accessible to most retail traders. Although this type of arbitrage requires taking on some risk, it is generally considered “playing the odds.” Here we will examine some of the most common forms of arbitrage available to retail traders. Arbitrage can be used whenever any stock, commodity, or currency may be purchased in one market at a given price and simultaneously sold in another market at a higher price. The situation creates an opportunity for a risk-free profit for the trader. This is one of the best forex trading strategies used by our robots.

Can you make money arbitrage trading?

There are several ways crypto arbitrageurs can profit off of market inefficiencies. One of them is Cross-exchange arbitrage: This is the basic form of arbitrage trading where a trader tries to generate profit by buying crypto on one exchange and selling it on another exchange. If the stock is trading at different prices on different exchanges, a simple arbitrage strategy entails buying the stock at a lower price on one exchange while at the same time selling it at a higher price on the other exchange.

What are the 3 types of arbitrage?

Arbitrage is commonly leveraged by hedge funds and other sophisticated investors. There are several types of arbitrage, including pure arbitrage, merger arbitrage, and convertible arbitrage. A classic example of arbitrage is vintage clothing. A given set of old clothes might cost $50 at a thrift store or an auction. At a vintage boutique or online, fashion-conscious customers might pay $500 for the same clothes.